Prudent Perspective – Q2 2018

“Don’t underestimate the value of doing nothing, of just going along, listening to all the things you can’t hear, and not bothering.”

– Winnie the Pooh

OVERVIEW

The market started the 2nd quarter on the back foot, buffeted by a volatility crash in February and followed up by the Facebook / Cambridge Analytica data scandal and steel and aluminum tariffs in March. By the beginning of April, the S&P had fallen 3.5% from the start of the year and was down an even more impressive 10% from the January highs.

While these events were cause for concern, they coincided with burgeoning earnings reports across all US sectors that improved valuations and provided us with some degree of comfort.

Through our analytical process, our investment committee concluded that continued strong fundamental data warranted maintaining the portfolios’ risk exposures, expecting strong earnings growth and accelerating share buybacks would get the market back on track.

As this letter is being written, the S&P has since rallied 9.2% and is back up 5.5% year-to-date with PEG (Price Earnings / Growth) ratios now looking more attractive than at the start of 2018.

Like our loveable little forest friend said above – for this last quarter while we have been watching and listening, there has been value in doing nothing.

Here are some of our recent observations.

CORPORATE EARNINGS CONTINUE TO CLIMB

With Q2 earnings season underway, companies appear poised to post very strong results once again. So far, earnings are growing 20.8% from a year ago on 9.0% revenue growth (according to Factset). Additionally, net profit margins have come in at 11.6%, which would match the level seen in the first quarter for the highest net profit margins for the S&P since data started being tracked in 2008. Looking out to the rest of the year, analysts anticipate net profit margins to increase even further to 11.8% in both the third and fourth quarters of 2018.

Fiscal Stimulus Fueling Economic Growth

Much of the increase in corporate profitability can be attributed to the corporate tax cuts. The tax cuts and additional government spending equate to nearly $275 billion of additional stimulus, which works out to ~1.4% of GDP. The additional dollars are finding their way into the economy and boosting consumer spending, which has lifted market consensus for Q2 GDP to 4.3%, a previously unthinkable level. Recently Barclays’ economic research team even increased their Q2 GDP growth forecast to an eyebrow-raising 5%! While these growth levels are not expected to be sustainable, they are indicative of the massive amount of stimulus that has been injected into the economy in recent months.

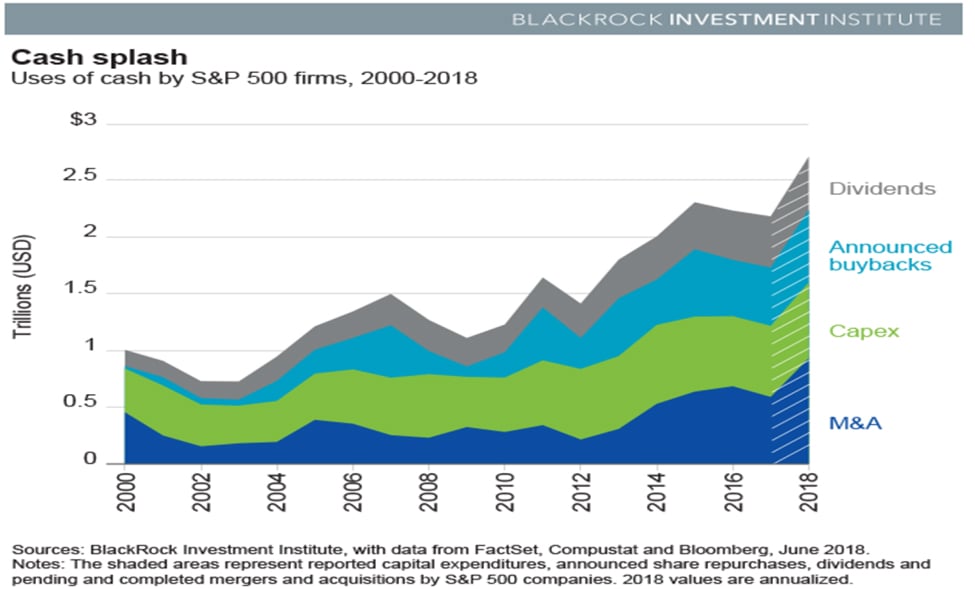

WHERE COMPANIES ARE SPENDING THEIR TAX CUTS

In the second quarter S&P companies announced nearly $437 billion in share buybacks (according to TrimTabs), smashing the previous record of $242bn, which was set in just the previous three months. This is a tax-efficient method companies use to return money to shareholders by re-acquiring their own shares and reducing their number of shares outstanding. 63 companies announced share buybacks of at least $1bn in Q2. Apple alone announced a $100 billion buyback in May and 19 financial companies contributed an additional combined $112 billion of buybacks. While capital expenditures saw an early increase of 24% in the first quarter, some analysts are concerned that tar-iffs and a potential looming trade war could dampen business investment during the latter half of this year and 2019.

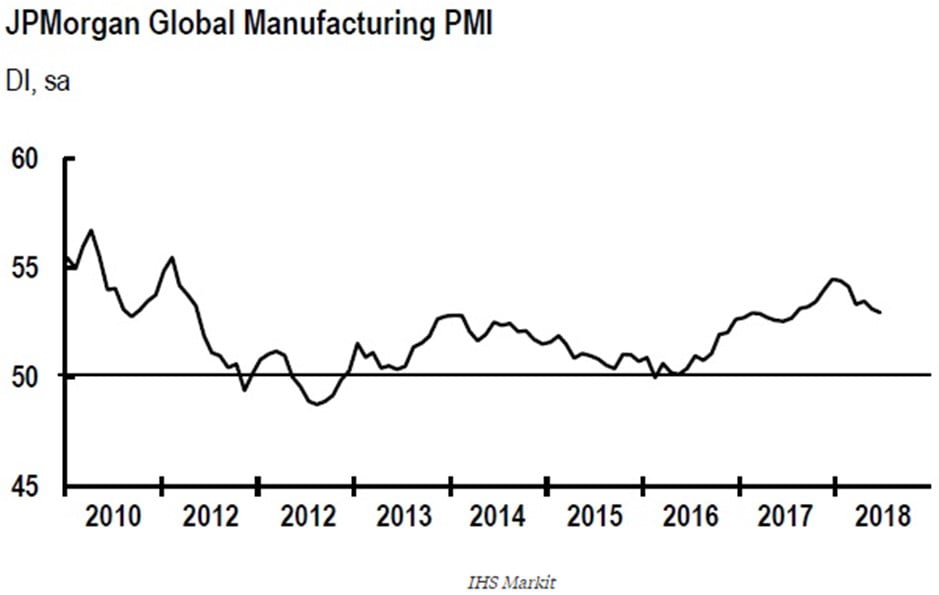

SLOWING INTERNATIONAL GROWTH

The IMF has expressed concerns about “large and sustained excess external imbalances in the world’s key economies,” noting that sustained current-account deficits could limit global growth. China has showed signs of a slowdown in recent months. Infrastructure spending fell to 6.1% growth, the slowest pace since 1996, while industrial production slowed to a 22-year low and retail sales fell to a 15-year low. Economists estimate that a trade feud with the US could reduce China’s GDP growth by 0.2% – 0.5% over the next 12 months.

STOCK MARKET OUTFLOWS

The tariff and trade war fears have spilled over into the broader sentiment, prompting investors to pull the most money out of mutual funds and ETFs since August 2015. In June alone, $22.1 billion was pulled from US open-end mutual funds and ETFs. Categories with the highest inflows in June included ultrashort bond funds and foreign large-blend funds.

FED CONTINUES TO TIGHTEN

The Federal Reserve hiked rates by another 0.25% in June, pushing the fed funds target rate to 1.75% – 2.00%. The futures markets are pricing in a 93% chance of another hike in September and a 66% chance of an additional hike in December. Meanwhile, the Bank of Japan is also talking of changing course and tightening its monetary policy, but is further behind the cycle with many expecting a policy change could come in October at earliest. The European Central Bank committed to stop buying new bonds by the end of this year, but yields have declined recently on European political turmoil across several government coalitions.

SUMMARY

While we remain concerned about how trade tariffs may impact global growth, we intend to keep the portfolios steady as earnings and economic data remain generally robust. We may pull some risk back if we see increased probability of a real trade war and we continue to monitor inflation closely, which has been steadily ticking higher.

In light of the overall market in the first half of the year, we have been generally pleased with the performance of our PIN portfolios. Our overweight stance on technology and energy and our decision to keep low interest rate exposure have been beneficial. By contrast, the aluminum and steel tariffs have been a hindrance to our aerospace and defense exposure, but fortunately we have kept these positions relatively small.

We appreciate working with you and look forward to serving you during the second half of the year.