Uniform Prudent Investor Act (UPIA)

Free Guide: Decoding the Uniform Prudent Investor Act

Take a copy of our free guide to the UPIA with you anywhere. Download now or save for later.

What is the Uniform Prudent Investor Act (UPIA)?

Unless you are working within the finance industry, most individuals invest for themselves or for their families, usually with a goal to grow assets. Trustees, guardians, and conservators, on the other hand, are fiduciaries and have a different responsibility.

Because they have taken on the unique responsibility to make decisions and act on behalf of others, they are duty-bound to manage investments in the best interest of someone other than themselves, be it a trust beneficiary, a living family member, or a child under conservatorship. Regardless, fiduciaries are held to a much higher standard than if they were investing their own assets. For many states this standard is known as the Uniform Prudent Investor Act (UPIA) and it has shaped the way fiduciaries invest since its issuance in 1994.

What is the Uniform Prudent Investor Act (UPIA)?

The Uniform Prudent Investor Act Origin

The Uniform Prudent Investor Act (UPIA) was created to provide trustees with specific standards and guidelines for managing investments within a trust. With the exception of Delaware and Louisiana, the UPIA, or a substantially similar act, has been codified into law in 48 of the 50 states, as well as the District of Columbia.

The Uniform Prudent Investor Act came in response to a prior act, the Prudent Man Rule, which was last revised in 1959. The Prudent Man Rule had its origins from an 1830 court case, Harvard College v Amory, which formulated a groundbreaking opinion that people in charge of other people’s money needed to manage that money with the same care, skill, and caution as if the money were their own. In other words, a trustee needed to act as a “prudent person” by being a good and wise steward of the investments. Even more important, fiduciaries were to act in the client’s best interest at all times. These concepts have been a cornerstone of trustee investing ever since.

The Prudent Man Rule required revision and clarification because of how it defined “care, skill, and caution” and the factors that the trustee needed to consider. The Prudent Man Rule emphasized that the trustee should not be speculative and should consider the “probable safety of capital invested,”, as well as “probable income.” This standard was to be applied to each individual investment made by the trust. That is, each investment was to be judged on its own merits; if an investment lost money, the fiduciary could be held liable.

Over time, trustee investing became increasingly conservative in order to avoid risk and comply with the Prudent Man Rule. Part of the reason for this was a court interpretation that trustees were not allowed to delegate investment powers to someone else.

Additionally, until the early 1940’s, most states required trustees to choose from a specific list of “safe” investments, such as government bonds, mortgages, and fixed income notes of stable companies. As a result, trustees felt the safest thing to do was to use conservative investments.

As the understanding of investments and economics evolved, it became clear that strictly investing in “safe” bonds was often harmful to trust beneficiaries. Only investing in fixed income and other conservative instruments meant that the trust corpus was more susceptible to inflation. Many times, the grantors (i.e., the original creator of the trust) were the original trust beneficiaries who ended up seeing the impact of inflation through their reduced purchasing power. Successor beneficiaries were also harmed by only focusing on preserving a trust’s principal. It meant that the remainder trust corpus was not invested for growth.

The Uniform Prudent Investor Rule

In 1993, the Uniform Prudent Investor Rule, as part of the 3rd Restatement of Trusts, was issued to fix these problems. It kept the fiduciary’s duty to act in the beneficiary’s best interest, while exercising care, skill and caution, but also made five fundamental changes to the former Prudent Man Rule. The rule states that:

- Investments are to be judged in the context of the overall trust portfolio, not the individual investment

- Trustees need to balance the tradeoff between risk and return

- Investment restrictions are eliminated and trustees are free to invest in any type of investment that helps meet the goals of the trust

- Diversification is mandatory

- Investment and management functions may now be delegated to investment professionals

These updates modernized trust investing in a few ways. Trustees are no longer handicapped by that restrictive investment style of the Prudent Man Rule that just focused on income. Instead, trustees are encouraged to focus on “total-return investing,” that is the combined return from both income and growth of capital.

The Uniform Prudent Investor Act also gives trustees the right to delegate investment authority to others. Even more importantly, it removed the subjectivity around what was safe and appropriate for trusts and replaced it with an investment process built on sound economic and investment principles. These investment concepts - risk versus return and diversification - are the basis for what a trustee needs to understand in order to follow the Uniform Prudent Investor Act.

Modern Portfolio Theory (MPT)

Modern Portfolio Theory

At the heart of the Uniform Prudent Investor Act and the principles of risk, return, and diversification is Modern Portfolio Theory (MPT). This theory was introduced by Harry Markowitz in two seminal papers written 1952 and 1959, and his pioneering work later won him the 1990 Nobel Prize in Economics.

Risk and Return

Markowitz proposed that there was a relationship between risk and return - investors are willing to take on greater risk when there is potential for greater return. In other words, even though there might be essentially risk-free assets, e.g. US Treasuries, investors are willing to invest in riskier assets in order to obtain a return that meets their investment objective.

Markowitz wanted to know if it was possible to construct a portfolio based on an investor’s required return while reducing the portfolio’s overall potential risk of loss. He was able to show mathematically that there was a way to combine assets together in a portfolio while actually decreasing the portfolio’s risk. The key to reducing risk was through diversification.

Diversification

Diversification is the old adage, “don’t put all your eggs in one basket.” By spreading out a portfolio’s risk factors across multiple assets, an investor gains a higher probability of achieving the desired return.

Markowitz proposed that there is risk that can be diversified away, which is the risk that is unique to companies or sectors. For example, a shift in a government’s energy policy could affect the oil and energy sector. An accounting scandal, such as with Enron, could impact a large company previously thought to be a reliable investment.

According to Markowitz, an improperly diversified portfolio will be over concentrated in a specific stock, bond, or sector to the potential detriment of the portfolio’s returns. But through proper diversification, a portfolio’s risk can be reduced so that the risk-adjusted return is more efficient than a portfolio invested in just a few related companies. Markowitz taught that a diversified portfolio can be less volatile than the individual assets comprising it because diversification reduces individual company or sector risk in the portfolio overall.

Correlation

But how does a trustee know if a portfolio’s underlying assets are diversified? Or how does one create a portfolio that is properly diversified? Markowitz, in his papers, explained that there was a simple way to determine this using a mathematical concept called correlation.

Correlation represents a relationship between the returns of two or more investments. If these investments both go up or down in value at the same time, then the investments are said to be positively correlated.

Finally, if the investments are not related in their movements, then the investments are considered non-correlated.

Correlation is an important part of Modern Portfolio Theory because it provides a measurable way to determine whether individual portfolio assets are related to each other. In Modern Portfolio Theory, this measurement used in conjunction with measurements of risk and return can help find a more efficient portfolio than one that is not diversified.

To use a simple example, if two assets are negatively correlated and combined together into a portfolio, the result would be a portfolio with less volatility. The below scenario is purely hypothetical, but it shows the impact that understanding correlation can have on portfolio construction.

If correlation is not part of the portfolio creation process, then the portfolio itself might end up being exposed to more risk than necessary. A portfolio might seem to generate a good return while taking on less risk, but when the underlying securities are highly correlated the portfolio will actually have higher risk and a higher potential for loss.

This is why Uniform Prudent Investor Act statute state that:

(b) A trustee's investment and management decisions respecting individual assets must be evaluated not in isolation but in the context of the trust portfolio as a whole and as a part of an overall investment strategy having risk and return objectives reasonably suited to the trust.

To manage a portfolio in the client’s best interest, a trustee should consider the portfolio’s risk and return objectives. And in order to know if a portfolio is taking on more risk than necessary, a trustee can use correlation to determine whether the portfolio is properly diversified.

To manage a portfolio in the client’s best interest, a trustee should consider the portfolio’s risk and return objectives. And in order to know if a portfolio is taking on more risk than necessary, a trustee can use correlation to determine whether the portfolio is properly diversified.

It is important for trustees to understand the general concepts of Modern Portfolio Theory, such as risk, return, and diversification. If trustees are unfamiliar with these principles and seek to invest according to a strategy of investments with the highest potential for return, they may unknowingly create a portfolio that is not appropriately diversified or that has a high amount of risk.

Considerations of the Trustee

What You Need to Know

In addition to understanding Modern Portfolio Theory, there are other important aspects of the Uniform Prudent Investor Act that a trustee needs to be aware of when supervising the investments. Regardless if a trustee is experienced or new to the role, these considerations must be applied on a consistent ongoing basis because economic, market, and legislative conditions are constantly changing.

Uniform Prudent Investor Act, Section 2, state that a trustee should be reviewing:

- The expected tax consequences of investment decisions or strategies (c)(3)

- The role each investment or course of action plays within the overall trust portfolio, i.e. financial assets, real estate, closely held businesses, tangible and intangible property, etc. (c)(4)

- The expected total return from income and the appreciation of capital (c)(5)

- Other resources of the beneficiaries (c)(6)

- Needs for liquidity, regularity of income, and preservation or appreciation of capital (c)(7)

- An asset’s special relationship or special value to the purposes of the trust or to one or more beneficiaries (c)(8)

Each of these considerations should be made in context of the requirements to diversify and manage the portfolio’s risk as part of complying with the UPIA.

Taxation

Expected tax consequences of investment decisions or strategies (c)(3).

Trusts can be taxed differently depending on the purposes and provisions. For example, revocable trusts are usually set up to benefit the grantor (the person funding the trust) and as a result, gains and distributions are passed through to the beneficiary’s income tax bracket. On the other hand, irrevocable trusts are taxed by the IRS at the trust level and not at the individual tax bracket level.

A trustee who is less familiar with trust taxation might find the UPIA statute daunting because of the interplay between taxes, income, and total return. For example, there are situations when the selling of specific assets within a trust, in order to help bring the trust in compliance with the diversification mandate, could result in large capital gains. If a trustee is managing an irrevocable trust, the impact of realized capital gains is even greater because of the trust’s compressed tax bracket.

A trustee should work with both the CPA and the investment advisor to develop an appropriate plan for the investments. Aside from realizing gains, there are other potential tax considerations that might apply to the trust: principal versus income assignment with regards to mutual fund short-term and long-term capital gain dividend distributions, step up in basis, or retaining eligibility for government benefits. This is where having both a qualified advisor and CPA can be extremely beneficial.

Trust Portfolio

The role each investment or course of action plays within the overall trust portfolio (which could include financial assets, real estate, closely held businesses, tangible and intangible property, etc) (c)(4).

It is very important that a trustee look at the trust portfolio as a whole. This might include other assets such as real estate, tangible property like art or collectibles, and intangible property such as copyrights, royalties and even cryptocurrencies.

In some cases, assets held by a trust might not have historical data for valuation. Without this data, a trustee might not be able to easily determine whether the trust is properly diversified. However, the trustee is under obligation to properly inventory the estate and create a plan for these assets. The trustee should utilize experts who can help determine the value of these assets and any potential risk related to these types of investments.

Total Return

The expected total return from income and the appreciation of capital (c)(5).

As mentioned earlier, it is important that a trustee look at the portfolio’s total return by considering both the return from growth and the income generated. The trust should be read closely, because many times there are both income beneficiaries and remainder beneficiaries.

For income beneficiaries, the amount of income they receive can be greatly influenced by their economic situation. Some trusts, such as special needs trusts, authorize distributions only for expenses that fall under certain conditions, such as health, education, maintenance, and support (HEMS). These types of expenses can be greatly impacted by inflation. Inflation can vary widely and historically health and education expenses have risen faster than regular living expenses.

Remainder beneficiaries, on the other hand, are more concerned about the asset’s growth. Income distributed from the trust will obviously reduce the amount that the remainder beneficiary can inherit.

In these situations, the trustee will need to balance the competing needs of the income and remainder beneficiaries based on the wording of the trust. Section 6 of the UPIA, which discusses the duty of impartiality, states that

“If a trust has two or more beneficiaries, the trustee shall act impartially in investing and managing the trust assets, taking into account any differing interests of the beneficiaries.”

A trustee plays an important role in determining the type of return needed to fulfill the trust’s terms while still being impartial. A trustee might need to target a specific return in order to fulfill an income beneficiary’s needs while satisfying the trust’s objectives for the remainder beneficiaries. This return will require a certain amount of risk to be taken. It is the trustee’s job to identify the appropriate levels of risk and return while taking into account the unique requirements of the trust for beneficiary distributions and remainder beneficiaries.

Resources

Other resources of the beneficiaries (c)(6).

It is also important for the trustee to determine if the beneficiaries of the trust have other resources that would impact the trustee’s decision making. This can directly impact the criteria for distributions.

A trust may have specific stipulations on the distribution of income or principal based on the current needs of a beneficiary. If the beneficiary has inherited or acquired additional assets that would change the trust’s distribution schedule, this could potentially alter the risk or return requirements of the trust. Trustees need to know both the trust document and the needs of the beneficiaries in order to properly fulfill their fiduciary obligations.

Liquidity

Needs for liquidity, regularity of income, and preservation or appreciation of capital (c)(7).

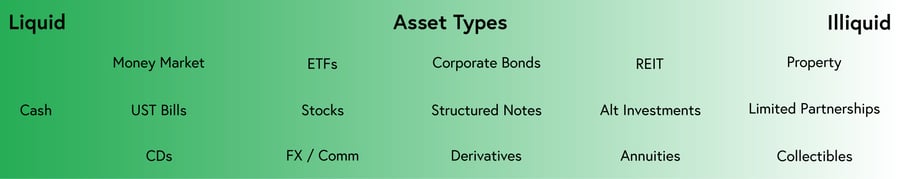

When supervising or managing investments, a trustee also needs to consider whether investments are sufficiently liquid. Investments that are less liquid are often more risky, but may also have a greater chance of appreciation. On the flip side, they can also be challenging to transact in and out of.

If a trust requires a regular distribution of income, then certain investments might not be appropriate if they are not liquid. This is why a trustee should understand the definition of liquidity and how it relates to the trust’s investments. Liquidity refers to the speed at which an asset can be converted to cash without impacting the investment’s market price.

Liquidity Example: An annuity is an example of a popular investment that is easily convertible to cash. However, annuities that have surrender charges (5 to 7 year periods is not uncommon) would not be considered liquid. This is because selling the annuity back to the insurance company results in a large surrender penalty charge of up to 10%. This surrender charge in turn affects the proceeds from the sale. So although investing in an annuity could provide a regular source of income, the annuity itself might be inappropriate for a trust if the trust allows for large distributions to occur outside the normal annuity schedule.

Special Relationships

An asset’s special relationship or special value to the purposes of the trust or to one or more beneficiaries (c)(8).

When reviewing the trust, a trustee should take special note of any assets listed in the trust that have special value or purpose. Section 1(b) of the UPIA says, "The prudent investor rule, a default rule, may be expanded, restricted, eliminated, or otherwise altered by the provisions of a trust.”

This means a trust could dictate to a trustee to avoid selling a specific asset due to it having a special relationship to the trust or beneficiary. This might be an heirloom or some other prized asset. Often, this scenario may be related to a home or other real estate held within a trust.

A trust might stipulate that a home should not be sold until a surviving spouse has passed away. The trustee should be aware that, ultimately, the trust document can supersede the requirements of the UPIA. When acting as trustee, the trustee should read the trust closely to determine when and where the UPIA would not apply.

All these considerations are important for the trustee to take into account. These considerations also must be made in context of the UPIA, except for scenarios where the trust, through its language, takes precedence over the UPIA. This is why it is important for the trustee to work with professionals familiar with trustee investing. These professionals can assist with drafting a comprehensive financial plan of the trust assets that can help the trustee be compliant with the statutes of the act.

Delegation and Compliance

Investment Delegation and Compliance

One of the critical changes the UPIA made to the 1959 rule was the authority to delegate. Section 9 of the code allows for delegation, but charges the trustee to exercise care, skill, and caution when:

- Selecting an agent

- Establishing the scope and terms of the delegation in relation to the trust

- Monitoring and reviewing the agent’s performance and compliance

Trustees do not have to delegate their investment decision making. However, if they do not have the knowledge or experience to make investment decisions according to the standards provided by the UPIA, it is recommended that they delegate this responsibility to an investment advisor who does have that expertise.

According to the UPIA, trustees who properly delegate their investment authority and appropriately monitor are not held liable for the decisions made by the investment advisor.

Selecting an Agent

When selecting an advisor, trustees need to show that they have done appropriate due diligence. This can include using websites such as FINRA or the SEC to verify licensing, disclosures, and/or complaints.

A trustee should also understand the differences between suitability and fiduciary standards. Financial professionals who follow the suitability standard are duty-bound to provide investment advice suitable for the situation, but are not obligated to act in the client’s best interest. Investment advisers who follow the fiduciary standard are required to put the client’s best interest first. One of the reasons why a trustee should understand these differences is to make sure the financial professional’s methods align with the trustee’s.

Compensation

Financial professionals who follow a suitability standard are more likely to be compensated on a commission basis, while those who follow a fiduciary standard are more likely to be compensated on an ongoing fee basis. However, UPIA compliance for a trust portfolio is not a one-time event; the stock market, economic conditions, and political environments are constantly changing. Trustees generally use investment advisors who follow the fiduciary standard because they are compensated on an ongoing basis for their advice. The adviser is obligated to put the trustee’s best interests first, which aligns with the trustee’s own legal requirements of fiduciary duty.

Finally, there are also representatives who are dually licensed, which means they operate under both the suitability and fiduciary standard. If the trustee chooses to work with a dually licensed individual, they should have clear written agreements as to which standard is being adhered to.

Managing Costs

Another aspect of selecting an agent is the trustee’s duty to manage costs. Section 7 of the UPIA states:

“In investing and managing trust assets, a trustee may only incur costs that are appropriate and reasonable in relation to the assets, the purposes of the trust, and the skills of the trustee.”

When selecting an agent, the trustee should consider the various costs that may be incurred because of the investment professional’s management. These may include commissions, underlying mutual fund or ETF expense ratios, adviser management fees, trading expenses, and even additional trust accounting costs for portfolio trades. According to the UPIA, the trustee is responsible to make sure that the fees charged are reasonable and within current industry standards.

Establishing the Scope of Delegation

A trustee who is working with an investment advisor should institute a specific process. Part of this process may involve questionnaires or supporting documentation related to the trust or trust beneficiary. This documentation plays a critical role in the trust’s investment process and can be used as evidence of delegation. Some of the information that may be provided to the advisor could be:

- The account title. This can help the advisor determine the type of trust that needs to be managed. The title on the account will also indicate who has authority to act as trustee.

- Contact information for those who will act as trustee.

- The date of the trust, most recent amendments, or court appointment dates for court supervised trusts.

- Income/expenses and whether the income and expenses are inflating or non-inflating.

- Age of the beneficiaries to determine life expectancy time frames.

- Mental and physical health status of the beneficiaries.

- Copies of investment statements with accurate tax basis of the assets included.

- Copy of most recent tax return.

As part of the delegation process, the investment advisor should create an Investment Policy Statement based on the information provided.

Investment Policy Statement

An Investment Policy Statement (IPS) is a written document drafted by either the advisor, the fiduciary, or the two together. Based on the trust information and trust beneficiary information provided by the trustee, the IPS should provide general investment goals and objectives for the account. The statement may outline the general rules for the manager to follow in managing the portfolio. The document is usually a written agreement between the fiduciary and the investment advisor.

Investment Recommendation

Within the IPS should be an Investment Recommendation (IR). The recommendation should be specific in providing investment objectives and a suitable benchmark with which to measure performance. It also may describe strategies the investment advisor may employ to meet these objectives. Specific information on asset allocation procedures, diversification, risk management, returns expectations, and liquidity requirements may also be included.

These investment strategies and objectives should be made with UPIA compliance in mind. The IR should address whether the portfolio will be managed or unmanaged and whether the investment advisor will have management discretion. By carefully choosing the advisor and giving management discretion, the trustee is able to start transferring potential liability for management of the assets to the advisor.

Monitoring and Reviewing the Agent's Performance and Compliance

Liability is not transferred, however, if the trustee does not monitor and review the investment advisor’s performance. If the trustee has delegated management, the investment recommendation should also provide the required reporting parameters agreed upon between the trustee and advisor. These reporting requirements should be related to the UPIA’s requirement for risk, return, and diversification. The requirements should also specify the frequency of the reports and the period of time used for review.

As trustees review the trust’s investment returns, risk, and its compliance with the UPIA, they should review it in light of Section 8 of the UPIA which states:

“Compliance with the prudent investor rule is determined in light of the facts and circumstances existing at the time of a trustee’s decision or action, and not by hindsight.”

Certainly not all investment decisions will be successful, but it is important that a trustee show evidence of monitoring the advisor. Ongoing monitoring is also a way to provide evidence that the advisor sought to comply with the UPIA throughout the investment management process. If the monitoring determines that the trust is off course and not meeting the objectives, the fiduciary should request corrective measures lest they risk the chance of being held liable for mismanagement due to neglect. The ability to delegate investment authority provides a way for a trustee, who might not have the necessary expertise, to still stay compliant with the UPIA. But it does require a continual collaboration between the trustee and investment advisor. Done properly, trustees are able to displace their investment liability to the financial professional.

Financial Expertise

Leveraging Expertise of an Advisor

Leveraging the expertise of an investment advisor can be an essential piece of complying with the UPIA. Those acting as a new family trustee may not yet know the ropes of their duties and legal responsibilities in the role. A trusted investment advisor following a fiduciary standard of care can help navigate the unique aspects of trustee investing, including UPIA compliance.

Complying with these guidelines is core to the role of a professional trustee. Whether looking to establish a relationship with a new investment advisor or pivoting to an advisor who specializes in UPIA compliance, it is important to build an investment management process in a way that properly delegates authority and reduces trustee liability. This means finding an advisor who understands Modern Portfolio Theory in the context of trustee investing and is familiar with managing the portfolio under the mandates of the UPIA.

The advisor and the trustee should work together to create an appropriate plan that details the expectations for delegation, monitoring, and reporting. This is how trustees can honor their role as fiduciaries and fulfill the investment duties on behalf of the trust and its beneficiaries.

From helping trustees understand the concepts of the Modern Portfolio Theory, to delegation practices, to our extensive knowledge of the UPIA, Prudent Investors is here to help. Prudent Investors offers flexibility and personalization that many other companies cannot accommodate.

Our goal is to protect trustees by helping them manage assets safely within the standards of the code and helping them successfully meet the financial objectives of the trusts they diligently serve.

This guide is general communication being provided for informational purposes only. This information is in no way a solicitation or offer to sell securities or investment advisory services. It is educational in nature and not to be taken as advice or a recommendation for any specific investment product or investment strategy. This does not contain sufficient information to support an investment decision. Any investment or investment strategy mentioned may not be suitable for all investors or in their best interest. Statistical information, quotes, charts, references to articles or any other quoted statement or statements regarding market or other financial information is obtained from sources which we believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. All rights are reserved. No part of this guide including text, graphics, et al, may be reproduced or copied in any format, electronic, print, et al, without written consent from Prudent Investors. Prudent Investors does not provide legal or tax advice. Please be advised to consult with your investment advisor, attorney or tax professional before making any investment decisions.