Prudent Perspective – Q1 2018

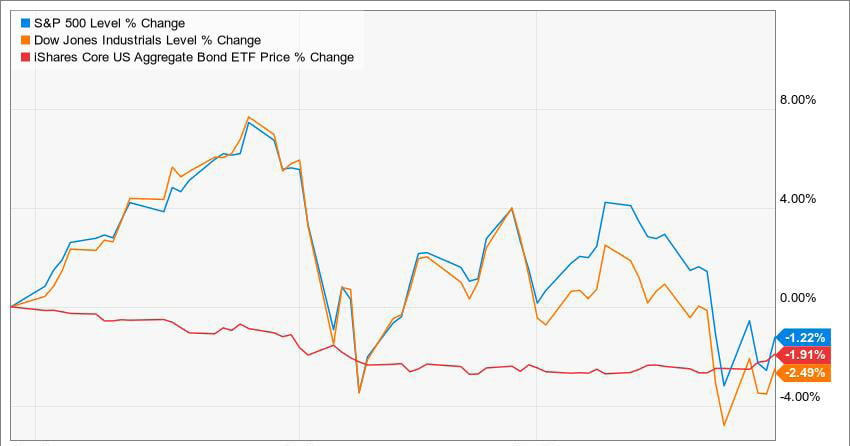

Two streaks broken in two weeks. UMBC’s win over Virginia broke a 135-game win streak of #1 over #16 seeds and the Dow and S&P broke a 10-consecutive streak of positive quarters. Through the first three months of the year, the DOW closed 2.49% lower and the S&P declined 1.22%. Bonds similarly fell as interest rates rose higher – the AGG (most recognized US Investment Grade Bond Index) fell 1.91% over the same period. In PIN’s 2017 annual letter, we shared our positive view toward the fundamental health of the economy but voiced our concerns about market valuations and the potential reaction we might see if inflation (and in particular wage growth) were to exceed the public’s expectations. While we didn’t expect to see this level of volatility in the first three months, the general performance and overall outcome has not been unusual or surprising. As long term investors we strive to maintain a disciplined approach and recognize that while some uncertainty is causing the market to behave disorderly over the near term, conditions remain favorable over the long term.

A Quarter of Disorder – 1st Quarter 2018

Early optimism surrounding corporate tax cuts boosted stocks to their best January since 1997; prompting $58 billion of equity inflows over a four-week period that month (largest ever according to Bank of America Merrill Lynch). The sentiment didn’t last long, however, as markets tumbled over February and March and volatility returned to its highest levels in 2.5 years. A few notable factors can be attributed to the increased turbulence rippling through the market:

Inflation Fears

The nonfarm payrolls report released on February 2 once again showed solid jobs growth and strong employment; but the key piece of data that caught investors’ attention was a 2.9% increase in wage growth (this has since been revised down to 2.5%), the highest in eight years. This spurred discussion of a fourth rate hike for 2018 and bond yields raced higher, causing both fixed income and equity investments to sell off hard the following week.

Volatility

In February, market volatility reached 2.5 year highs as the selloff was further amplified by the bursting of the short-volatility bubble, which forced investors to sell stocks to cover margin calls on wrong-way volatility bets that exploded against them. Exchange-traded volatility ETFs used to enhance yields became highly popular in recent years as volatility fell to historically low levels, but many of these products were obliterated when the CBOE Volatility Index (VIX) jumped more than 100% in just one session. The most well-known short volatility ETF was XIV – the chart above illustrates its performance since 2013 and how rapidly it crashed the first week of February.

Trade Policy

Investors globally were initially unsettled by President Trump’s proposal to apply tariffs to all steel and aluminum imports, but the US’s willingness to carve out nearly all of its allies from the new scheme provided some relief (US exempting Canada, Mexico, Germany, Italy, UK, France, Netherlands, Spain Austria, South Korea, Brazil, Argentina, and Australia). The more significant concern at this point is worries of a potential trade war as the US ups its aggression towards China to address its $375 billion trade deficit to its Asian rival across the globe. US officials say China has behaved unfairly on tech-related intellectual property, which has placed considerable pressure on the sector.

Tech Turmoil

The bigger issue plaguing the tech sector, of course, involves Facebook’s recent data breach with Cambridge Analytica. The public backlash has not only hit the tech titan, but spilled into other social media rivals and tech firms. In recent days Amazon has been under fire after President Trump lashed out against the company and voiced concerns the world’s largest retailer is not paying its fair share of taxes.

Stronger Earnings and Lower Valuations

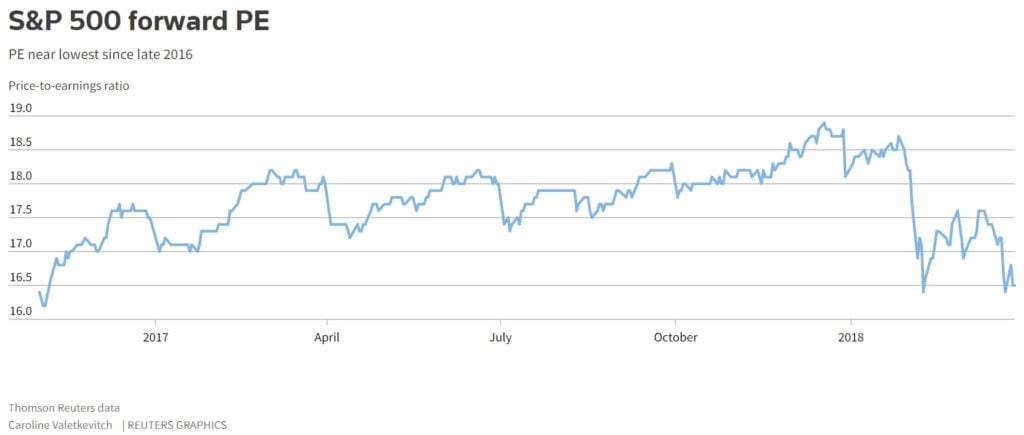

Earnings season kicks off in two weeks (April 13), and reports are expected to be very positive. According Thomson Reuters, corporate profits are expected to rise 18.5% in Q1, which would be the highest in seven years. The improved profit outlook combined with a drop in share prices has brought forward P/E multiples to their lowest levels since late 2016.

Outlook

This was a volatile first quarter and it is very possible that the volatility will persist. There continues to be uncertainty around US trade policy, it is unclear what new regulation will be introduced in the tech sector, and the Federal Reserve Board (Fed) continues to indicate its sensitivity to potential growing inflation. That said, it is healthy that the S&P 500 is now 8.1% below its January highs and experienced its first correction (in February) in two years. We believe current valuations and more balanced investor sentiment provides a better environment for longer-term sustainable growth.

Positioning

We are focused more on shorter-term duration for fixed income and still like tech and industrial sectors.